Stephen Ukandu, Umuahia

Abia State has generated over N6 billion in the first quarter of 2023 according to the state’s Board of Internal Revenue.

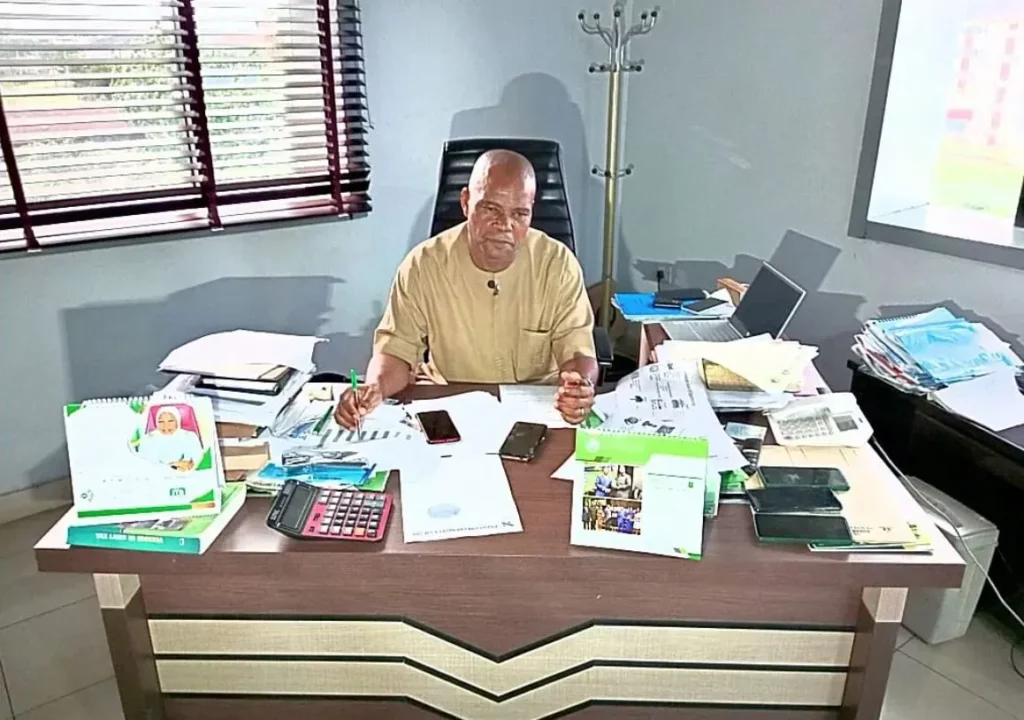

Chairman, BIR Abia State, Chijioke Okoronka, who disclosed this in Umuahia, said the state had a projection of N24 billion as IGR for the year, adding that it also targets N3 billion monthly as IGR.

The BIR boss acknowledged a significant improvement in the state’s IGR, and attributed the success to the introduction of technology in revenue drive in the state.

“There were innovations and changes in modern system of doing things that propelled the achievement we made,” he said.

According to him, the success recorded was due to the application of technology with the use of mobile application pay system and creation of data base which captures records of plate numbers of commercial tricycles and vehicles.

“We moved from manual ticketing to E-ticketing, in fact, Abia state was the first state to implement it and it was so good and it expanded from Keke (tricycle) to every part of the transport sector and to the markets,” Chijioke said.

“The entire revenue is driven by E-ticketing platform which is a wonderful innovation. We saw the state moving our revenue from less than a hundred million to over two hundred million, it was a very radical increase,” Chijioke revealed.

The BIR boss said that the new revenue innovation had reduced faking, and other challenges associated with paper ticketing.

He said that E-ticketing “cannot be duplicated” because of the security features applied.

According to the BIR boss, the state generated 19.20 billion in 2021; and 19.80 billion in 2022 while N24 billion; N30 billion and N40 billion are projected for 2023, 2024, and 2025 respectively.

He said that the state IGR before now was below N100 million per month but now over N200 million monthly.

The BIR boss urged Ministries, Agencies and Departments in the state to queue into the database of revenue collection to prevent financial leakages.

He explained that the on-going clampdown on illegal revenue collection was also part of the successes being witnessed in the sector.

The BIR boss discouraged residents from paying cash to revenue collectors, stressing that the BIR has a law that prohibits people from paying cash to anyone.

“A technical system put in place makes it easy for tax payers to get alert as they pay,” he said.

He further disclosed that the Board had designed a new policy known as “Pay Small Small” where tax could be paid in installments.

“We are moving gradually to make payments seamless for tax payers using technology,” he said, adding that the mode of tax collection in the state is through Point of Sale ( POS).